Category:Finance

Version:2.0.13

Size:69.90M

Updated:2024-09-14

Language:English

Ratings:281

Package ID:com.shinhan.smartloan

Developer:신한저축

Introducing the 신한저축은행 모바일대출 - 스마트금융 app, a convenient and accessible solution for all your loan needs. With this app, you can apply for a loan 24 hours a day, making the process more convenient and hassle-free. The app offers a range of services, including integrated limit inquiry to help you find the loan product that suits you best. You can also submit your ID and employment/income documents electronically, streamlining the application process. Additionally, the app allows for electronic contract and loan progress inquiry, making it easier to manage your loan. For existing customers, you can access My Page loans to check your loan account, repay principal and interest, issue certificates, and make changes to your automatic transfer account.

- Convenience at your fingertips:

신한저축은행 모바일대출 - 스마트금융 allows you to apply for a loan 24 hours a day, providing ultimate convenience and accessibility. You no longer have to wait for the bank's operating hours or visit a branch in person. Simply download the app and apply for a loan anytime, anywhere.

- Integrated limit inquiry:

With the app's integrated limit inquiry feature, you can easily find the loan product that suits you best. It provides personalized recommendations based on your needs and financial situation, ensuring that you get the loan that fits your requirements.

- Digital document submission:

Gone are the days of submitting physical documents for loan applications. 신한저축은행 모바일대출 - 스마트금융 allows you to submit your ID card and employment/income documents electronically. This seamless digital process saves time and effort, making the loan application process hassle-free.

- Electronic contract and progress inquiry:

Once your loan is approved, you can proceed with the remaining steps, such as electronic contract and loan progress inquiry, all within the app. This feature eliminates the need for extensive paperwork, simplifying the loan process and making it more efficient.

- Keep your documents ready:

To ensure a smooth and fast loan application process, make sure to have your ID card and employment/income documents ready in digital format. This way, you can easily submit them through the app and avoid any delays or hassles.

- Explore different loan products:

Take advantage of the app's integrated limit inquiry feature to explore different loan products offered by Shinhan Savings Bank. Compare the terms, interest rates, and repayment options to find the loan that best suits your needs and financial situation.

- Familiarize yourself with the loan terms:

Before applying for a loan, make sure to thoroughly read and understand the terms and conditions, including the interest rates, repayment period, and any applicable fees. Being aware of the loan terms will help you make informed decisions and manage your finances effectively.

신한저축은행 모바일대출 - 스마트금융 offers unparalleled convenience and efficiency for borrowers. With its round-the-clock availability, integrated limit inquiry, digital document submission, and electronic contract features, the app makes applying for a loan a seamless and hassle-free experience. By following the playing tips of keeping documents ready, exploring different loan products, and familiarizing yourself with the loan terms, you can make the most out of 신한저축은행 모바일대출 - 스마트금융 and find the loan that best fits your needs. Don't miss out on this user-friendly and time-saving financial solution. Download the app now and experience the future of mobile banking.

ERP - Manage Your Business

Download

petsXL | smart animal health

Download

Financial Times: Business News

Download

Mesereando Restaurant TPV +QR

Download

Bldc

Download

دفتر الحسابات

Download

Kiko Live: Sell on ONDC

Download

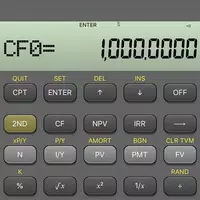

BA Financial Calculator

Download

First Security Bank

Download

Track Budget&Expense -Cute Cat

Download