Category:Finance

Version:4.4.2

Size:12.80M

Updated:2024-10-15

Language:English

Ratings:168

Package ID:com.bridge2capital

Developer:XTRACAP FINTECH

Bridge2Capital: Business Loan is a groundbreaking mobile application that is revolutionizing the way small businesses in India access financial services. With a 360° financial health approach, this app has everything a small business owner needs to thrive. Firstly, the app offers a paid financial health check, thoroughly analyzing credit reports, bank statements, and GST data to provide a detailed report on the business's financial behavior and health. Additionally, the Bridge2Capital: Business Loan app features a cutting-edge digital hissab, allowing users to effortlessly manage their day-to-day finances, associate transactions with specific individuals, and access daily reports. Lastly, the app provides short-term unsecured business loans, offering invoice financing and flexible repayment options.

* 360° FHC: The app offers a comprehensive financial health check for small businesses. This detailed analysis includes a review of credit bureau reports, bank statements, and GST data. By assessing 15 different parameters, the app provides a comprehensive report that reflects the financial behavior and health of small business owners.

* Hissab: The app's Digital Hissab is a digital bahi khata specifically designed for small businesses. This mobile app allows users to maintain their day-to-day hissab on their smartphones, making it accessible anywhere. They can also associate the hissab with specific individuals, such as owners and customers. Additionally, the app provides daily reports and features like transaction notifications, reminders for due payments, and the ability to save softcopies of hard receipts.

* Business Loan: As a B2B platform, the app offers short-term unsecured business loans to small businesses in partnership with IIFL. These loans function as working capital limits and are provided on a revolving basis. The app's business model focuses on invoice financing and ensures 100% end utilization of funds. To maintain transparency, disbursements are made directly to GST suppliers against presented invoices. Flexible repayment options are available, with the loan repayable in different tenures up to 180 days.

* How does the 360° FHC analysis work?

The 360° FHC analysis involves a detailed check of various financial documents, such as credit bureau reports, bank statements, and GST data. It assesses 15 different parameters to evaluate the financial behavior and health of small business owners.

* Can I access my Digital Hissab on multiple devices?

Yes, the app's Digital Hissab can be accessed on multiple devices. As a mobile app, it offers the convenience of accessing your hissab from anywhere.

* How does the app ensure transparency in business loan transactions?

The app ensures transparency by making all disbursements to GST suppliers against invoices presented. This ensures that the funds are utilized for business purposes as intended.

Bridge2Capital: Business Loan offers small businesses in India a comprehensive financial solution through its mobile application. With a focus on providing on-demand financial services, the app covers areas such as business loans, savings, insurance, and a digital hissab. The 360° FHC analysis provides a detailed insight into the financial health of small business owners, while the Digital Hissab offers convenience and organization in maintaining daily financial records. Furthermore, the app's business loan model ensures transparency and flexibility in usage and repayment. For small businesses looking to bridge the financial gap and accelerate growth, the app is the ideal platform.

EquateMobile

Download

myMetLife Gulf Middle East

Download

ERP - Manage Your Business

Download

petsXL | smart animal health

Download

Financial Times: Business News

Download

Mesereando Restaurant TPV +QR

Download

Bldc

Download

دفتر الحسابات

Download

Kiko Live: Sell on ONDC

Download

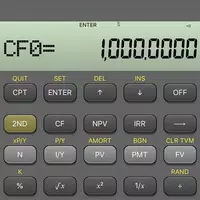

BA Financial Calculator

Download